I like music. Very much. I have about 700 pristine albums, vinyl and a few CD's. In some ways, musically, I never got past vinyl as CD's sounded too "engineered", surreal to me as there was a lack of realism to the recordings, likely from excess production engineering.

I use to take my albums and make one copy of them onto cassette tape. Never got to DAT. My ears could handle the hiss and the Dolby B reduction as usually I just cranked it up and the soft parts, well, there were no soft parts! Long live rock!

Flashforward. Maybe 30 CD's, 2 kids ... and a generation later. The sound recording industry is presented in public as being in shambles from Napster, then Peer to Peer. A huge

copyright reform package is presented, and well, I don't like it for other reasons: my computer is mine. The software I license is mine. The freeware I use, is mine cause someone else said I could have it (at least the compiled version). My harddrive to the CPU to the router and between is mine.

Thanks to Mark Russinovich of Sysinternals, he found the reason October 31, 2005 why the copyright reform package presented to Canadians by Sarmite Bulte's Committee for Copyright Reform should be dead, and for now is dead.

Thanks too to Michael Geist for exposing who funded Sarmite Bulte to be re-elected in 2004 and who is funding her current campaign.

Me? What can I do? I can help expose the real Canadian Sound Recording Industry, the version that Statistics Canada reports on infrequently, "87F0008XIE2005001"

Its hard to get around a Statistics Canada report that provides little analysis and lots of data.

But looking for any analysis, I could not find anything independent of the media coverage near the day of its release and the highlight that they had picked out, that new Canadian artist releases fell below 1,000 for the first time, since well, the media could remember.

I think at the time, Graham Henderson of the CRIA was quoted making some reference to this fall in Canadian releases in the media and said something about filesharing and theft caused this and how the copyright amendments were so needed to fix this.

Well I did a few graphs of the data, adding StatCan's tables 10.1 and 10.2 together to get industry totals. Table 10.1 was of the Canadian owned industry. Table 10.2 was the non-Canadian owned industry.

By the way if you click on any of the charts, they get nicer, and then just go back a page to carry on :-)

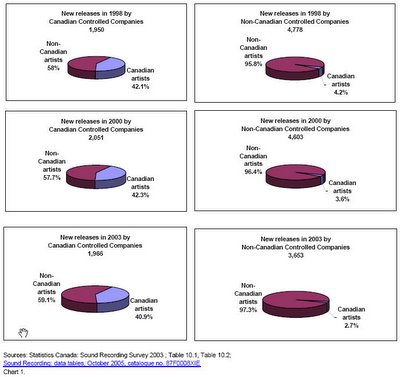

Chart 1:

Chart 1 shows that the Non-Canadian owned companies take care of their own a lot better than they take care of Canadian artist. Notice the drop from 4.2% of their new releases being Canadian artists in 1998, to just 2.7% in 2003? The Canadian owned companies seem to take care of Canadian artists. More on this later.

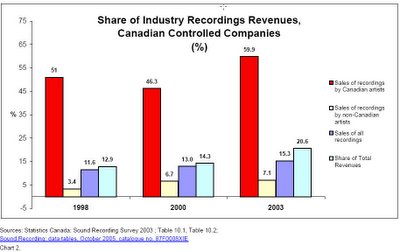

Chart 2:

Chart 2 shows how much more of the revenue from recordings, Canadian and non-Canadian, that the Canadian owned sector of this industry is responsible for as all areas show improvement between 1998 and 2003. Untold success story?

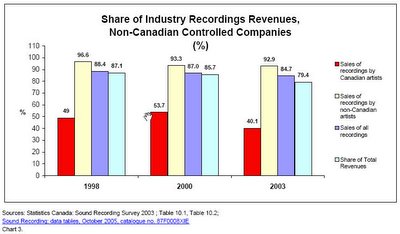

Chart 3:

This chart shows that the non-Canadian controlled companies are having a harder time, losing share to the Canadian owned companies. It also shows the domination of these foreign companies in the Canadian sound recordings market, outside of the Canadian artist sales, is slowly diminishing.

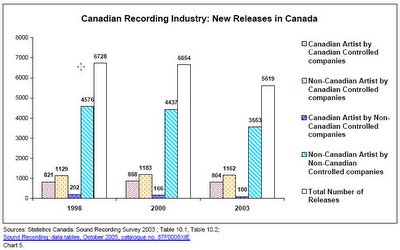

Chart 4:

This chart shows that the Canadian companies are picking up share in new releases. The striking figure is the falloff of the non-Canadian controlled companies Canadian artist new releases, from 20% in 1998 to 11% in 2003. In 1998 it was 80 / 20, 20 /80 for Canadian artist / foreign artist by Canadian company and foreign company. In 2003, its almost 90 /10, 25 /75.

Before one pops the corks of celebration of the "taking" back of the sound recordings industry, see the next chart for more perspective. The numbers of new releases are striking in particular the number of new foreign releases by the non-Canadian companies, demonstrating vividly how much Canadian product (NOT!) they like to push.

Chart 5:

For brevity, in 2003, the non-Canadian controlled companies new releases were 97.3 % foreign artist, an incredible 3,553 of them vs. 100 Canadian artist releases. Market demand, lowest marginal cost, or something else? We try to answer this later.

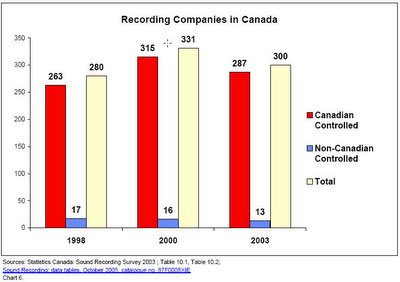

Chart 6:

This chart is my favourite, as it shows the consolidation in the industry amongst the non-Canadian controlled companies, a very interesting fact to the "whole" story. There were 17 of them in 1998, and by 2003, only 13 remained. Why is it my favourite? Because it adds great perspective overall to all the changes in this industry.

Chart 7:

The highlight of chart 7 is that it shows the average number of new releases per company was essentially flat amongst all the companies for these 3 years over the 6 years in the report. The fewer non-Canadian companies, each had the same number of new releases in 1998 and 2003 (281) per company. The foreign owned companies show average new foreign artist releases per company flat (+1.5%) but new Canadian artist releases dropped from 11.9 to only 7.7 per company, a 35% decline. The Canadian controlled companies show a slight drop of 0.6 new releases per company, to 6.8, a decline of 7.6% for the period.

With the foreign consolidation shown in Chart 6 in mind, Chart 7 shows the non-Canadian controlled companies produced for the Canadian market just as much in terms of new releases on a per company basis as they did before. With their sharp falloff in new Canadian artist releases however and fewer non-Canadian controlled companies, these facts become crucial to understanding what did occur in this industry.

Chart 8:

This shows that on balance, in terms of changes in recordings revenues, Canadian controlled companies did ok but not gangbusters with their increased market share. In constant dollars, their sales were likely flat for the period with revenues from Canadian releases falling, and their foreign cut deals rising.

Part 2 on this industry is coming soon with the blockbuster "Table 10. "

For a hint, let me say this: the claim that the fall off in sales is due to the theft of recordings has to be put up against the fall in the number of new releases by each of the fewer non-Canadian controlled companies, which is an entirely different problem than theft from filesharing, in my opinion. Industry revenues for the Canadian controlled companies were up $66,915,000 while the non-Canadian controlled companies were down $237,590,000, between 1998 and 2003. With the non-Canadian controlled companies new releases from non-Canadian artists down 22.4% and their new releases of Canadian artists down 50.5%, the non-Canadian controlled companies should be explaining this fact while the Canadian controlled industry is thriving in terms of revenue growth.

What if their new releases from their foreign repertoire did not fall 22%?

What if they did not drop like a stone their new Canadian artist releases by 50%?

Perhaps its not a Canadian problem at all. More to come.

Note: Statistics Canada collects data on a mandatory basis from all companies that operate in this fair land under the Statistics Act. They also publish that data in a non-identifying manner and are very tough to maintain confidentiality.

No other government institution – not even the RCMP or the Canada Customs and Revenue Agency – has the right to see the answers given in confidence to Statistics Canada.This particular survey is census in nature, with no one able to really back out of providing the information. For the "eggs", there is information on their methodology here.Your information is protected by:

- The Statistics Act

- The Privacy Act

(edited 11.01.2008)

No comments:

Post a Comment